- Accounts & Connection Management

- Data Management & Analysis

- Price Monitoring

- Charting

- Trading

- Scanners

-

Builders

-

Manual Strategy Builder

- Main Concept

- Operand Component

- Algo Elements

-

Use Cases

- How to create a condition on something crossing something

- How to create an indicator based on another indicator

- How to calculate a stop loss based on indicator

- How to submit stop order based on calculated price

- How to calculate a current bar price using a price type from inputs

- How to Use a Closed Bar Price

- Automatic Strategy Builder

-

Manual Strategy Builder

- Autotrading

- FinScript

- Trade Analysis

- Media Feeds

- Logs & Notifications

- UI & UX

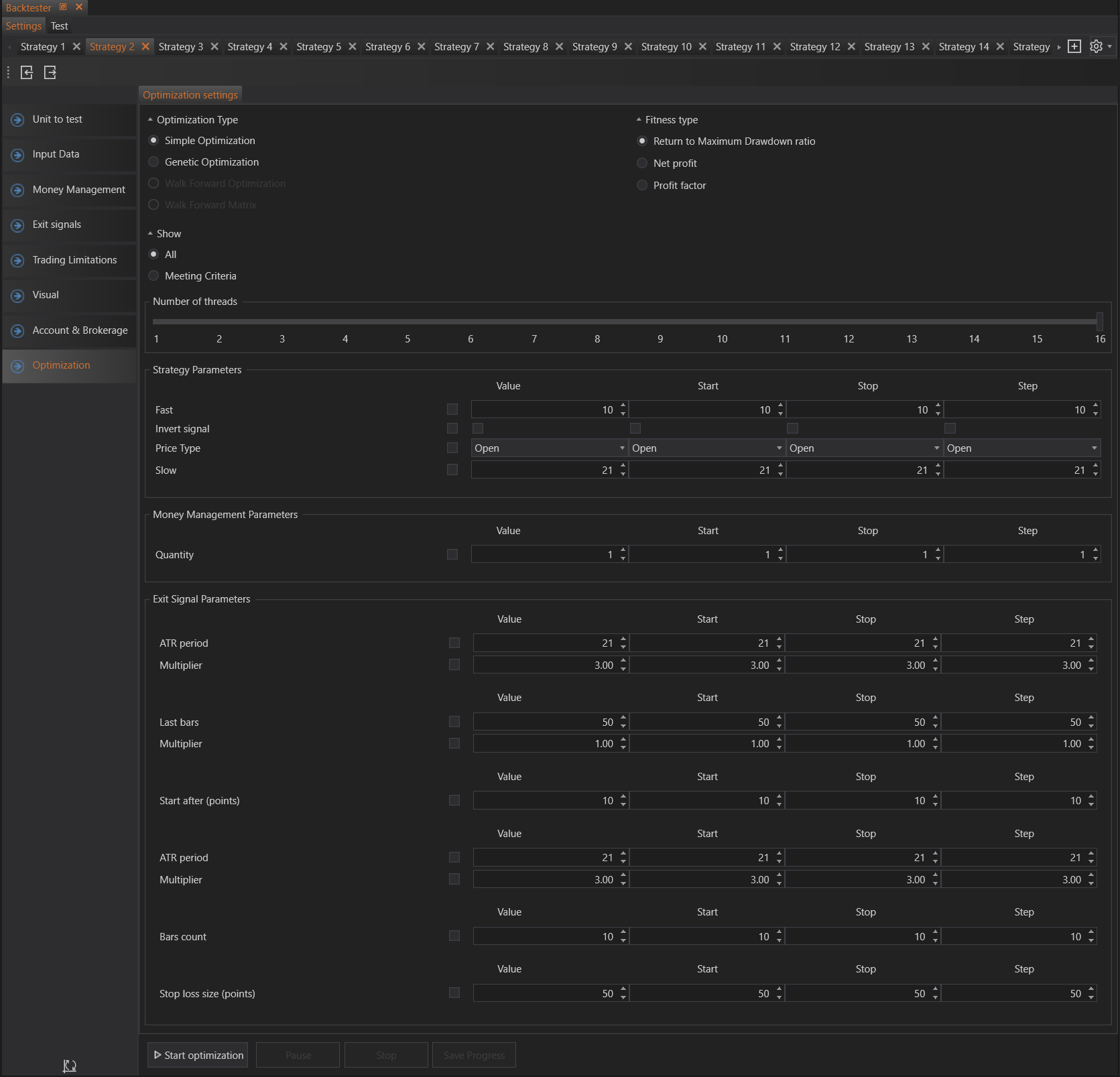

The Optimizer is a powerful tool designed to enhance automated trading strategies by fine-tuning their parameters. By setting specific optimization goals, traders can maximize profitability, minimize drawdowns, or optimize for other key performance metrics. This process involves running multiple iterations of the strategy with varying parameter sets to identify the most effective configurations.

Key Features of the Optimizer

Optimization Function

- Define the objective that the optimizer will seek to maximize or minimize. Common optimization goals include maximizing net profit, minimizing maximum drawdown, improving the profit factor, or any custom metric specified by the user.

Parameter Adjustment

- The optimizer systematically adjusts the parameters of the trading strategy. These parameters could include entry and exit conditions, position sizing rules, stop-loss and take-profit levels, and more.

Iterative Testing

- The optimizer runs the strategy through numerous iterations, each time with a different set of parameters. This exhaustive search helps in identifying the parameter combination that best meets the optimization objective.

Steps to Use the Optimizer

-

Set Optimization Goals

- Choose the performance metric you want to optimize. This could be net profit, drawdown, profit factor, return-to-drawdown ratio, etc.

- Choose the performance metric you want to optimize. This could be net profit, drawdown, profit factor, return-to-drawdown ratio, etc.

-

Select Parameters to Optimize

- Identify the parameters within your strategy that will be adjusted during the optimization process. Define the range and increments for each parameter to explore the potential configurations.

- Identify the parameters within your strategy that will be adjusted during the optimization process. Define the range and increments for each parameter to explore the potential configurations.

-

Run the Optimizer

- Start the optimization process. The optimizer will perform backtests for each parameter set within the defined ranges and evaluate their performance against the chosen optimization goal.

- Start the optimization process. The optimizer will perform backtests for each parameter set within the defined ranges and evaluate their performance against the chosen optimization goal.

-

Analyze Results

- Review the outcomes of the optimization. The results will typically include a summary of the best-performing parameter sets and detailed performance metrics for each iteration. Use this information to identify the optimal strategy settings.

- Review the outcomes of the optimization. The results will typically include a summary of the best-performing parameter sets and detailed performance metrics for each iteration. Use this information to identify the optimal strategy settings.

-

Implement Optimal Parameters

- Apply the best parameter set identified by the optimizer to your trading strategy. This should theoretically improve the strategy's performance based on historical data.

Benefits of Using the Optimizer

Improved Performance

- By systematically exploring various parameter configurations, the optimizer helps in uncovering the settings that yield the best performance. This leads to more effective and profitable trading strategies.

Time Efficiency

- Manual optimization of a strategy can be time-consuming and prone to human error. The automated optimizer significantly speeds up this process, providing a comprehensive analysis in a fraction of the time.

Enhanced Strategy Robustness

- Optimization helps in fine-tuning strategies to perform well under different market conditions. This robustness is crucial for maintaining consistent performance in live trading environments.

Customizable and Flexible

- The optimizer is highly customizable, allowing traders to define specific goals and parameters. This flexibility ensures that the optimization process aligns with the trader's unique objectives and trading style.

Conclusion

The Optimizer in FinStudio's Backtester is an essential tool for traders looking to enhance the performance of their automated trading strategies. By leveraging the optimizer, traders can systematically improve their strategies, ensuring they are well-equipped to achieve their trading goals.

- Accounts & Connection Management

- Data Management & Analysis

- Price Monitoring

- Charting

- Trading

- Scanners

-

Builders

-

Manual Strategy Builder

- Main Concept

- Operand Component

- Algo Elements

-

Use Cases

- How to create a condition on something crossing something

- How to create an indicator based on another indicator

- How to calculate a stop loss based on indicator

- How to submit stop order based on calculated price

- How to calculate a current bar price using a price type from inputs

- How to Use a Closed Bar Price

- Automatic Strategy Builder

-

Manual Strategy Builder

- Autotrading

- FinScript

- Trade Analysis

- Media Feeds

- Logs & Notifications

- UI & UX