- Accounts & Connection Management

- Data Management & Analysis

- Price Monitoring

- Charting

- Trading

- Scanners

-

Builders

-

Manual Strategy Builder

- Main Concept

- Operand Component

- Algo Elements

-

Use Cases

- How to create a condition on something crossing something

- How to create an indicator based on another indicator

- How to calculate a stop loss based on indicator

- How to submit stop order based on calculated price

- How to calculate a current bar price using a price type from inputs

- How to Use a Closed Bar Price

- Automatic Strategy Builder

-

Manual Strategy Builder

- Autotrading

- FinScript

- Trade Analysis

- Media Feeds

- Logs & Notifications

- UI & UX

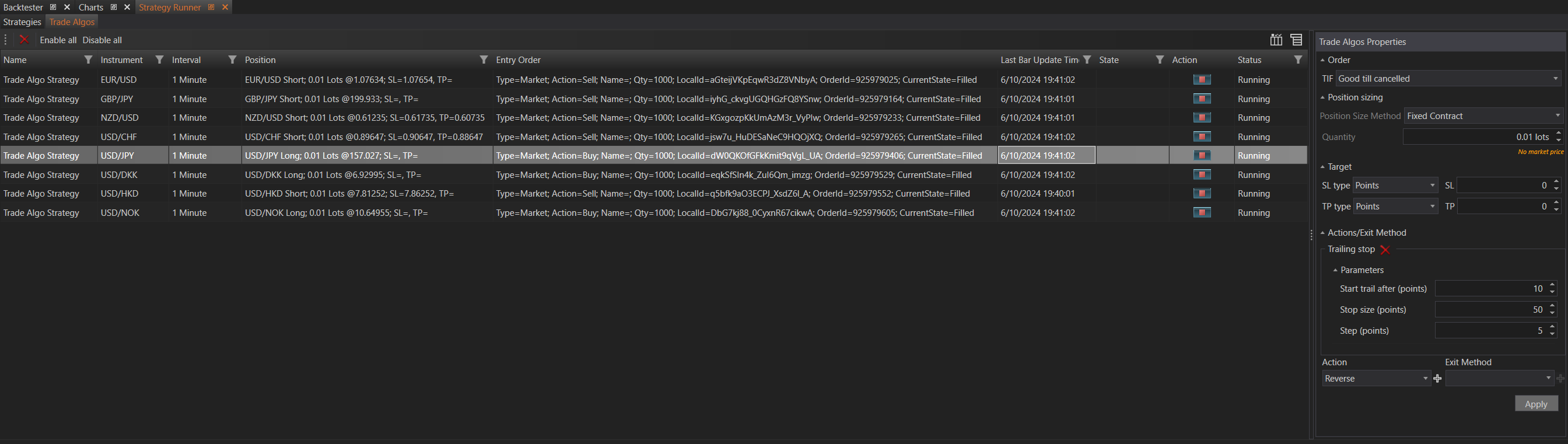

The Trade Algos section displays all trade algorithms running across the application. Trade Algos include actions and exit methods that are applied to trades, such as those configured from the Chart Trading Panel where users can place orders with custom actions or exit methods.

These actions and exit methods extend order functionality, allowing for programmable orders where users can customize the behavior of their orders during their lifetime.

Toolbar

The toolbar at the top includes several essential icons and functions:

- Delete Icon: Allows users to delete a selected trade algo from the list. This is useful for removing algorithms that are no longer needed or require modifications.

- Enable All: Activates all trade algos listed, ensuring they are operational and responding to market conditions as configured.

- Disable All: Deactivates all trade algos, halting their operation. This can be useful for pausing strategies during periods of high volatility or when reassessing trading strategies.

Main Section

The main section of the Trade Algos tab is divided into two parts: left and right.

Left Section (Trade Algo Table):

- This table provides information about each trade algo, with each algo displayed in a separate row.

- Columns include:

- Name: The name assigned to the trade algo, which helps in identifying the purpose or specific function of the algo.

- Instrument: The financial instrument (e.g., EUR/USD, AAPL) associated with the trade algo, indicating which market the algo is operating in.

- Interval: The time interval (e.g., 5 minutes, 1 hour) for the trade algo, defining the frequency at which the algo operates.

- Position: The position associated with the trade algo, showing whether it is long, short, or neutral.

- Entry Order: Details of the entry order that initiated the trade, providing context on how the trade was started.

- Last Bar Update: The timestamp of the last update or action taken by the algo, indicating how recently it has reacted to market changes.

- State: The current state of the algo, such as active, paused, or completed.

- Action: The specific action or series of actions the algo is programmed to perform.

- Status: The current status of the algo, showing whether it is running, stopped, or waiting for certain conditions to be met.

- Name: The name assigned to the trade algo, which helps in identifying the purpose or specific function of the algo.

Right Section (Algo Settings):

- When a specific algo is selected in the table, its settings and properties are displayed on the right side.

- Settings include:

- Detailed configurations that allow users to adjust the parameters and behavior of the selected algo.

- Options to modify entry and exit conditions, risk management settings, and other customizable parameters.

- The ability to save changes and apply new settings, ensuring the algo operates under the latest configurations.

- Detailed configurations that allow users to adjust the parameters and behavior of the selected algo.

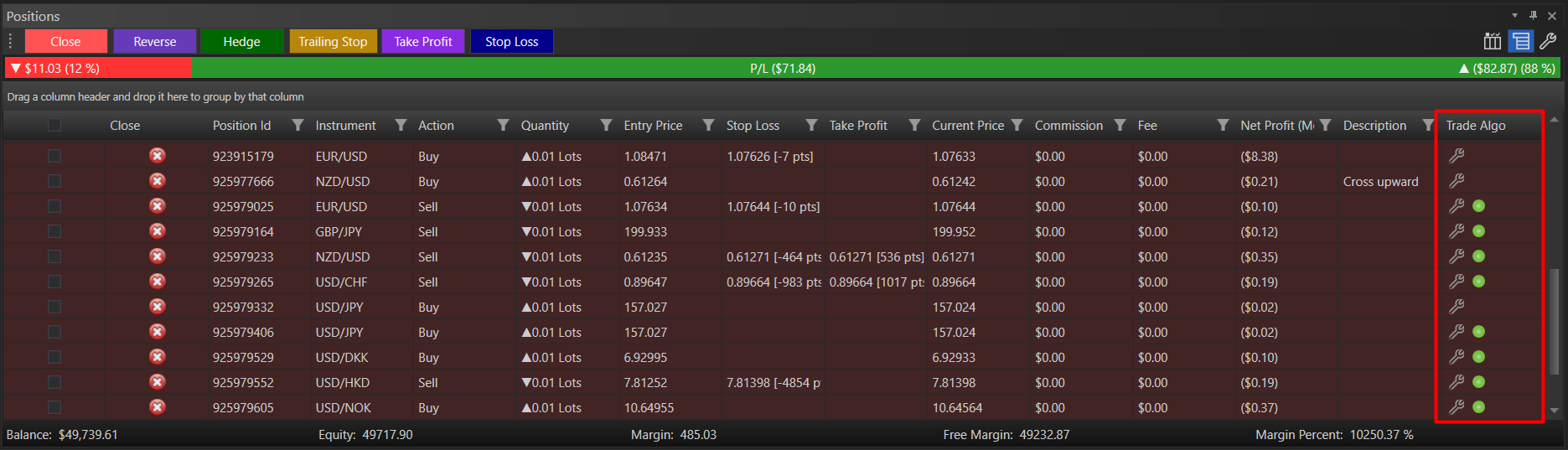

Integrating Trade Algos with Positions

If there is an active open position in the Positions module, users can see whether it has a trade algo attached. This is indicated in the Trade Algo column by:

- Settings Icon: Clicking this icon allows users to add a new trade algo to an existing position that does not have one. This is useful for enhancing the management of open trades with additional programmable actions or exit strategies.

- Green Icon: This icon shows that an active trade algo is currently running on that position. It provides a quick visual indicator of which positions are being managed by algos.

By integrating trade algos with positions, users can ensure that all trades are managed efficiently and according to predefined strategies. This comprehensive setup allows for effective management and adjustment of trade algorithms, enabling users to fine-tune their trading strategies and actions directly within the Strategy Runner module.

This detailed approach ensures that traders have full control over their automated strategies and can optimize their trading performance by leveraging sophisticated programmable actions and exit methods.

- Accounts & Connection Management

- Data Management & Analysis

- Price Monitoring

- Charting

- Trading

- Scanners

-

Builders

-

Manual Strategy Builder

- Main Concept

- Operand Component

- Algo Elements

-

Use Cases

- How to create a condition on something crossing something

- How to create an indicator based on another indicator

- How to calculate a stop loss based on indicator

- How to submit stop order based on calculated price

- How to calculate a current bar price using a price type from inputs

- How to Use a Closed Bar Price

- Automatic Strategy Builder

-

Manual Strategy Builder

- Autotrading

- FinScript

- Trade Analysis

- Media Feeds

- Logs & Notifications

- UI & UX