- Accounts & Connection Management

- Data Management & Analysis

- Price Monitoring

- Charting

- Trading

- Scanners

-

Builders

-

Manual Strategy Builder

- Main Concept

- Operand Component

- Algo Elements

-

Use Cases

- How to create a condition on something crossing something

- How to create an indicator based on another indicator

- How to calculate a stop loss based on indicator

- How to submit stop order based on calculated price

- How to calculate a current bar price using a price type from inputs

- How to Use a Closed Bar Price

- Automatic Strategy Builder

-

Manual Strategy Builder

- Autotrading

- FinScript

- Trade Analysis

- Media Feeds

- Logs & Notifications

- UI & UX

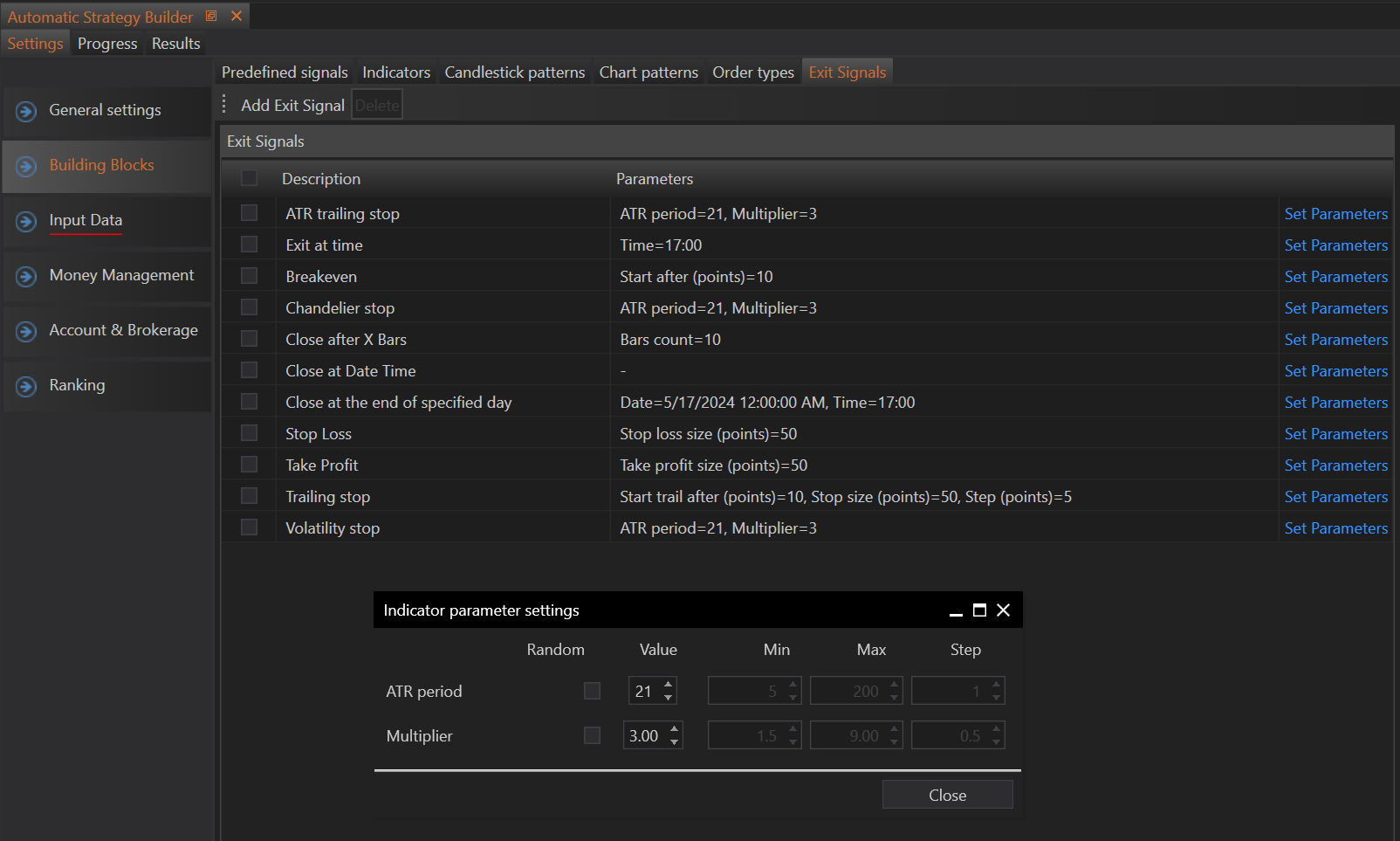

Exit Signals

The Exit Signals tab in the Automatic Strategy Builder (ASB) allows users to select and configure the signals used to close positions in their trading strategies. Users can add, remove, or modify exit signals, similar to the functionality available for predefined signals and indicators.

Overview of Exit Signals

Exit signals are essential for managing trades and controlling risk. They determine when to close a position, either to secure profits or limit losses. FinStudio provides a variety of exit signals by default, all of which can be integrated into the ASB.

Default Exit Signals

FinStudio offers the following exit signals, which can be used in the Automatic Strategy Builder:

- ATR Trailing Stop: Adjusts the stop price based on the Average True Range (ATR), providing a dynamic stop level that adapts to market volatility.

- Exit at Time: Closes the position at a specified time.

- Breakeven: Moves the stop price to the breakeven point once the position reaches a certain profit level.

- Chandelier Stop: Sets the stop price based on the highest high over a specified period, adjusted by a multiple of the ATR.

- Close after X Bars: Closes the position after a specified number of bars or periods.

- Close at Date Time: Closes the position at a specified date and time.

- Close at the End of Specified Day: Closes the position at the end of a specified trading day.

- Stop Loss: Closes the position once it reaches a specified loss level.

- Take Profit: Closes the position once it reaches a specified profit level.

- Volatility Stop: Adjusts the stop price based on market volatility, similar to the ATR trailing stop.

Configuring Exit Signals

Users can configure exit signals to match their specific trading strategies. Here are the steps to manage exit signals in the ASB:

- Add Exit Signal: Click the "Add Exit Signal" button to select an exit signal from the list of available options.

- Remove Exit Signal: Select the exit signal to be removed and click the "Delete" button.

- Modify Exit Signal Parameters: Select an exit signal and click the "Set Parameters" button to open the configuration window. Here, users can adjust the parameters to fit their strategy requirements.

Example of Configuring an Exit Signal

Suppose a user wants to add an ATR Trailing Stop as an exit signal and configure its parameters:

- Add ATR Trailing Stop: Click the "Add Exit Signal" button and select "ATR Trailing Stop" from the list.

- Set Parameters: Click the "Set Parameters" button next to the ATR Trailing Stop signal.

- Configure ATR Parameters: In the configuration window, set the ATR period and the multiplier used to calculate the trailing stop. For example, an ATR period of 14 and a multiplier of 3.

Using Exit Signals in Trading Strategies

Exit signals can be combined with other elements of the trading strategy to ensure effective risk management and profit-taking. For instance, a user might employ a Chandelier Stop for trailing stop-loss purposes and a Take Profit signal to secure gains once a certain profit target is reached.

Comprehensive Control and Flexibility

The ASB’s exit signal configuration options provide traders with comprehensive control over their trade exits. By selecting and configuring a variety of exit signals, users can tailor their strategies to meet specific risk management and profit objectives.

Summary

The Exit Signals section in the ASB empowers users to customize their trade exit methods, offering a variety of signals to suit different trading styles and market conditions. By allowing users to add, remove, and configure exit signals, the ASB enhances the precision and effectiveness of trading strategies. This flexibility ensures that traders can manage their positions with confidence, knowing their exit strategies are tailored to their specific needs and market scenarios.

- Accounts & Connection Management

- Data Management & Analysis

- Price Monitoring

- Charting

- Trading

- Scanners

-

Builders

-

Manual Strategy Builder

- Main Concept

- Operand Component

- Algo Elements

-

Use Cases

- How to create a condition on something crossing something

- How to create an indicator based on another indicator

- How to calculate a stop loss based on indicator

- How to submit stop order based on calculated price

- How to calculate a current bar price using a price type from inputs

- How to Use a Closed Bar Price

- Automatic Strategy Builder

-

Manual Strategy Builder

- Autotrading

- FinScript

- Trade Analysis

- Media Feeds

- Logs & Notifications

- UI & UX