- Accounts & Connection Management

- Data Management & Analysis

- Price Monitoring

- Charting

- Trading

- Scanners

-

Builders

-

Manual Strategy Builder

- Main Concept

- Operand Component

- Algo Elements

-

Use Cases

- How to create a condition on something crossing something

- How to create an indicator based on another indicator

- How to calculate a stop loss based on indicator

- How to submit stop order based on calculated price

- How to calculate a current bar price using a price type from inputs

- How to Use a Closed Bar Price

- Automatic Strategy Builder

-

Manual Strategy Builder

- Autotrading

- FinScript

- Trade Analysis

- Media Feeds

- Logs & Notifications

- UI & UX

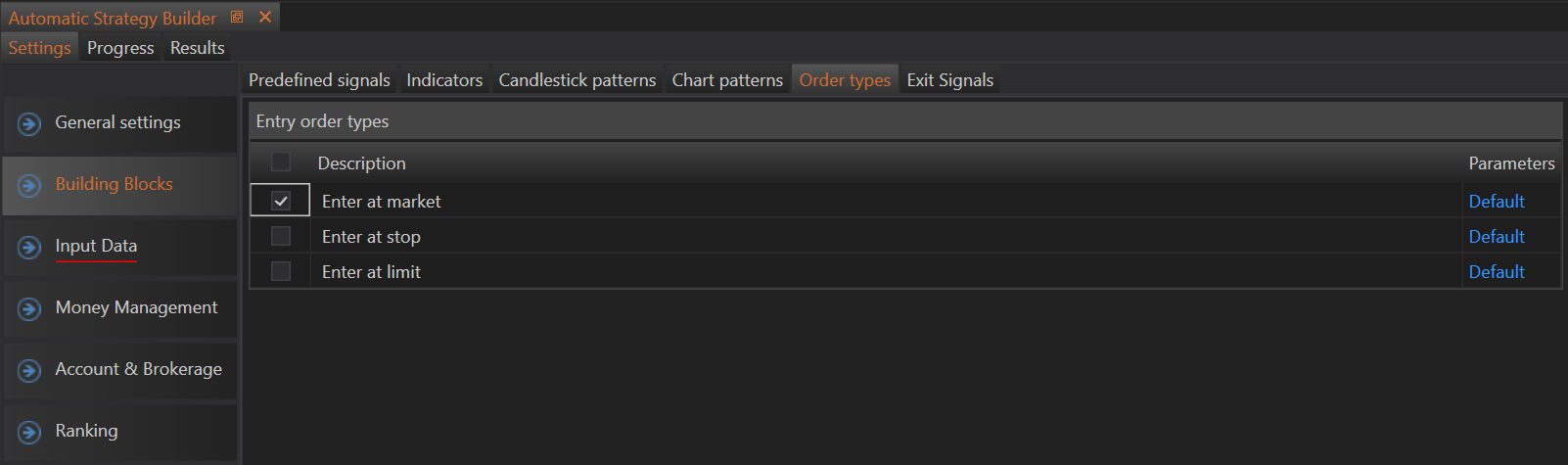

Order Types

The Order Types tab in the Automatic Strategy Builder (ASB) allows users to select and configure the types of entry orders used in their trading strategies. This section provides options for Market, Stop, and Limit orders, enabling users to tailor their order execution to match their trading preferences and market conditions.

Overview of Order Types

Choosing the appropriate order type is crucial for executing trades efficiently and effectively. The ASB supports the following types of entry orders:

-

Market Order: This type of order will be filled immediately once the signal to open a position occurs. Market orders prioritize execution speed and are filled at the current market price.

-

Stop Order: A stop order becomes a market order once the current price hits the specified stop price. Stop orders are used to enter a position once the price reaches a predetermined level, ensuring the trade is only executed when the market moves in a specified direction.

-

Limit Order: A limit order guarantees that the position will be opened at a price not worse than the limit price. Limit orders are used to enter a position at a specified price or better, providing control over the entry price and ensuring that trades are not executed at unfavorable prices.

Configuring Order Types

To configure order types in the ASB:

- Select Order Type: Navigate to the Order Types tab and choose the desired order type (Market, Stop, or Limit).

Market Order

- Execution: The market order will be executed immediately at the current market price once the signal to open a position is triggered.

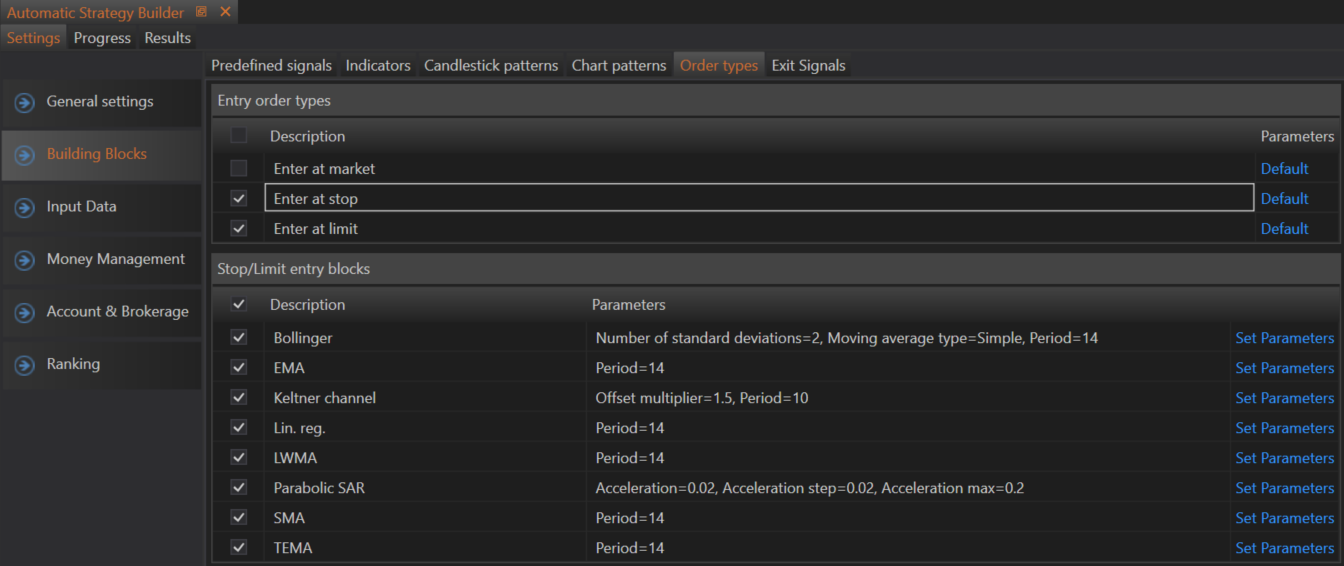

Stop Order

- Setting Stop Price: If a stop order is selected, the user must specify the stop price. This is the price at which the order becomes a market order and is executed.

- Indicator-Based Calculation: Users can choose an indicator based on which the stop price will be calculated. This allows for dynamic stop prices that adjust according to market conditions.

Limit Order

- Setting Limit Price: If a limit order is selected, the user must specify the limit price. This is the maximum price at which the order will be executed.

- Indicator-Based Calculation: Users can choose an indicator based on which the limit price will be calculated. This ensures that the limit price adapts to market conditions, providing flexibility and precision in trade execution.

Example of Configuring Stop and Limit Orders

Suppose a user wants to use a stop order and calculate the stop price based on the Moving Average (MA) indicator:

- Select Stop Order: Navigate to the Order Types tab and select the Stop order.

- Choose Indicator: Select the Moving Average (MA) indicator for calculating the stop price.

- Set Stop Price: Configure the stop price settings based on the MA indicator, ensuring the stop price adjusts dynamically according to the market conditions.

Similarly, for a limit order:

- Select Limit Order: Navigate to the Order Types tab and select the Limit order.

- Choose Indicator: Select the Moving Average (MA) indicator for calculating the limit price.

- Set Limit Price: Configure the limit price settings based on the MA indicator, ensuring the limit price adapts dynamically to provide favorable entry points.

Comprehensive Control and Flexibility

The ASB’s order type configuration options provide traders with comprehensive control over their trade execution. By selecting and configuring market, stop, and limit orders, users can ensure their trading strategies align with their risk tolerance and market outlook.

Summary

The Order Types section in the ASB empowers users to customize their trade entry methods, offering Market, Stop, and Limit orders to suit various trading styles and market conditions. By allowing users to configure these order types and link them to dynamic indicators, the ASB enhances the precision and effectiveness of trading strategies. This flexibility ensures that traders can execute their strategies with confidence, knowing their orders are tailored to their specific needs and market scenarios.

- Accounts & Connection Management

- Data Management & Analysis

- Price Monitoring

- Charting

- Trading

- Scanners

-

Builders

-

Manual Strategy Builder

- Main Concept

- Operand Component

- Algo Elements

-

Use Cases

- How to create a condition on something crossing something

- How to create an indicator based on another indicator

- How to calculate a stop loss based on indicator

- How to submit stop order based on calculated price

- How to calculate a current bar price using a price type from inputs

- How to Use a Closed Bar Price

- Automatic Strategy Builder

-

Manual Strategy Builder

- Autotrading

- FinScript

- Trade Analysis

- Media Feeds

- Logs & Notifications

- UI & UX