- Accounts & Connection Management

- Data Management & Analysis

- Price Monitoring

- Charting

- Trading

- Scanners

-

Builders

-

Manual Strategy Builder

- Main Concept

- Operand Component

- Algo Elements

-

Use Cases

- How to create a condition on something crossing something

- How to create an indicator based on another indicator

- How to calculate a stop loss based on indicator

- How to submit stop order based on calculated price

- How to calculate a current bar price using a price type from inputs

- How to Use a Closed Bar Price

- Automatic Strategy Builder

-

Manual Strategy Builder

- Autotrading

- FinScript

- Trade Analysis

- Media Feeds

- Logs & Notifications

- UI & UX

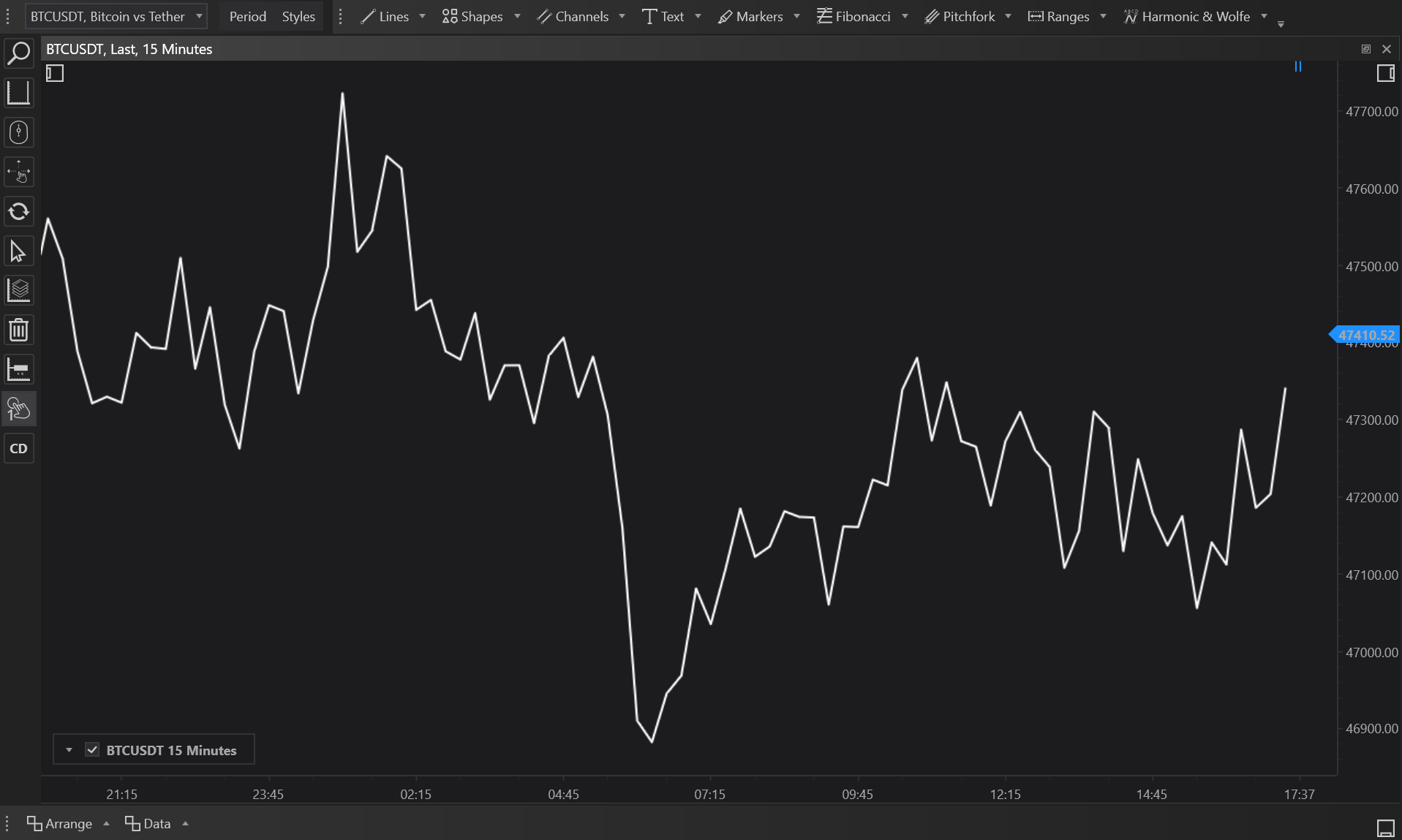

Line on OHLC Charts: Precise Market Trend Visualization

Line on OHLC (Open, High, Low, Close) charts in FinStudio are designed to offer traders a streamlined and precise method for tracking market trends. These charts simplify the visualization of price movements by drawing lines through selected price points within each trading period. This article will explore the history, principles, types, and uses of Line on OHLC charts, emphasizing their functionality within FinStudio.

History and Origins

The concept of Line on OHLC charts is rooted in the simplification of traditional charting methods. Historically, traders used various forms of charting to depict price actions, such as candlestick and bar charts, which provided comprehensive views but could overwhelm with details. Line charts, evolving as a part of this progression, focus solely on specific aspects of price data to offer clarity and direct insights into market trends.

Basic Principles of Line on OHLC Charts

Line on OHLC charts is characterized by their focus on singular price points within each time period:

- Open: The line connects the opening prices of each period.

- High: The line connects the highest prices of each period.

- Low: The line connects the lowest prices of each period.

- Close: The line connects the closing prices of each period.

These charts provide a cleaner view of market movements, highlighting trends and potential reversal points without the distraction of the full range of intra-period price action.

Types of Line on OHLC Charts in FinStudio

FinStudio provides several variations of the Line on OHLC chart, each tailored to different trading preferences:

- Line on Open Values: Focuses on the opening prices, ideal for understanding the initial market sentiment at the beginning of trading periods.

- Line on High Values: Connects the peak prices, useful for identifying resistance levels and peak market conditions.

- Line on Low Values: Links the lowest prices, aiding in spotting support zones and minimum price levels.

- Line on Close Values: Follows the closing prices, often considered the most critical in evaluating the final market consensus for the period.

Usage of Line on OHLC Charts

Line on OHLC charts are versatile, suitable for various market analysis tasks:

- Trend Tracking: Easily identifies the direction of market movements by simplifying the visualization of critical price points.

- Support and Resistance Identification: Helps in pinpointing where prices tend to encounter support or resistance.

- Market Sentiment Analysis: Depending on the line type used, these charts can provide insights into market sentiment at open, the volatility within the period, or the consensus at close.

Applications and Benefits

- Clarity and Focus: By eliminating other price details, traders can focus on the price points that matter most to their strategy.

- Customizable Analysis: Traders can switch between different OHLC values depending on what aspect of price action they are interested in, providing flexibility in technical analysis.

- Integration with Other Analytical Tools: Line on OHLC charts can be used in conjunction with other technical indicators and analytical methods to form a comprehensive trading strategy.

Pros and Cons

Pros:

- Simplicity: Offers a straightforward and uncluttered view of price movements.

- Focus: Enhances the ability to concentrate on specific price actions, making it easier to follow trends.

- Versatility: Useful across various time frames and market conditions.

Cons:

- Limited Information: Does not provide the full picture of market dynamics that other chart types might offer, such as the range of prices within a trading period.

- Potential for Oversimplification: May overlook significant intra-period price actions that could be crucial for some trading strategies.

Conclusion

Line on OHLC charts in FinStudio are an excellent tool for traders who value precision and clarity in their market analysis. By focusing on key price points, these charts simplify the task of identifying trends and potential turning points in the market. While they offer less comprehensive data than other chart types, their simplicity and directness can make them an invaluable part of a trader's analytical arsenal, especially when combined with other forms of technical analysis.

- Accounts & Connection Management

- Data Management & Analysis

- Price Monitoring

- Charting

- Trading

- Scanners

-

Builders

-

Manual Strategy Builder

- Main Concept

- Operand Component

- Algo Elements

-

Use Cases

- How to create a condition on something crossing something

- How to create an indicator based on another indicator

- How to calculate a stop loss based on indicator

- How to submit stop order based on calculated price

- How to calculate a current bar price using a price type from inputs

- How to Use a Closed Bar Price

- Automatic Strategy Builder

-

Manual Strategy Builder

- Autotrading

- FinScript

- Trade Analysis

- Media Feeds

- Logs & Notifications

- UI & UX