- Accounts & Connection Management

- Data Management & Analysis

- Price Monitoring

- Charting

- Trading

- Scanners

-

Builders

-

Manual Strategy Builder

- Main Concept

- Operand Component

- Algo Elements

-

Use Cases

- How to create a condition on something crossing something

- How to create an indicator based on another indicator

- How to calculate a stop loss based on indicator

- How to submit stop order based on calculated price

- How to calculate a current bar price using a price type from inputs

- How to Use a Closed Bar Price

- Automatic Strategy Builder

-

Manual Strategy Builder

- Autotrading

- FinScript

- Trade Analysis

- Media Feeds

- Logs & Notifications

- UI & UX

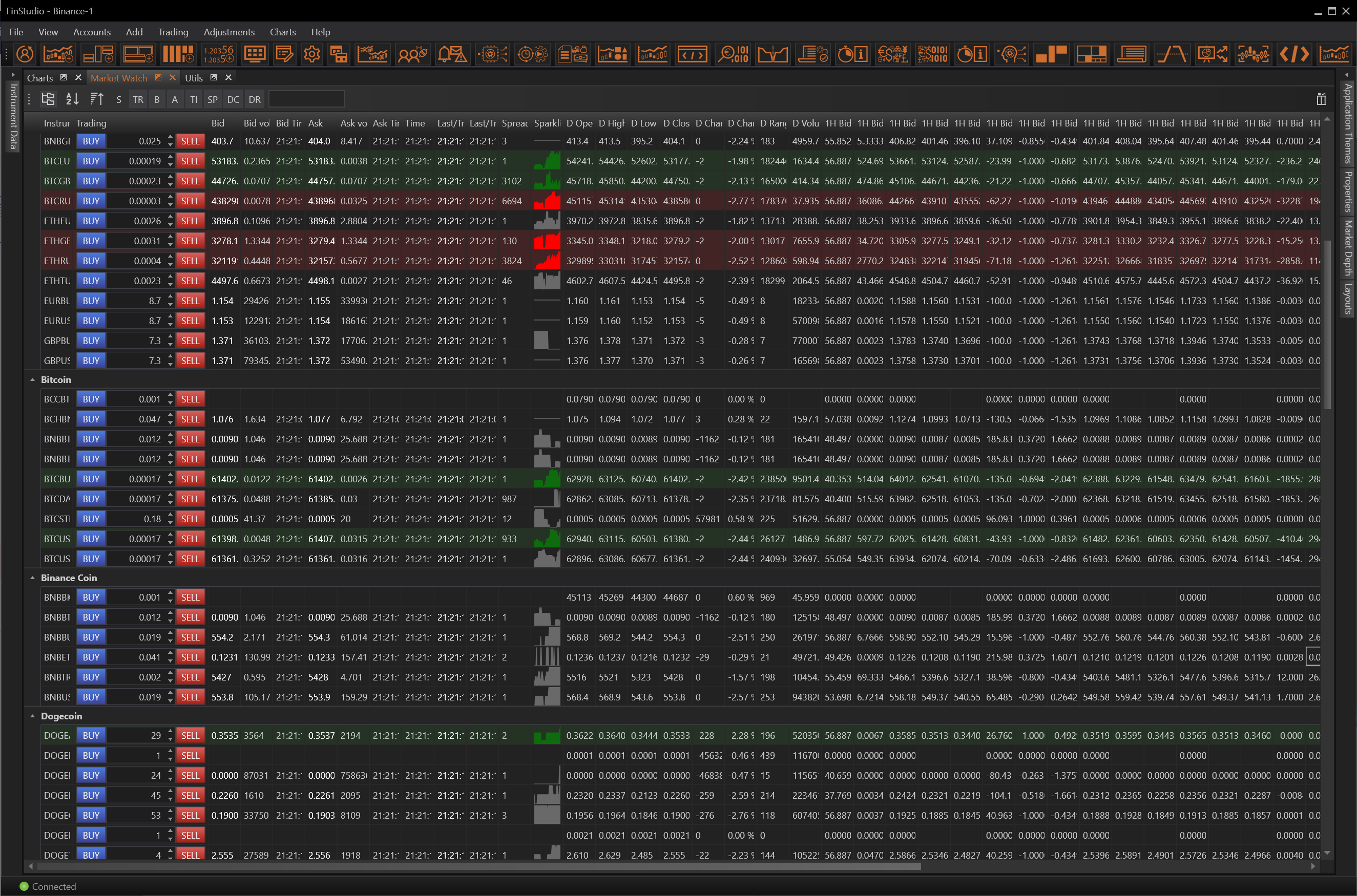

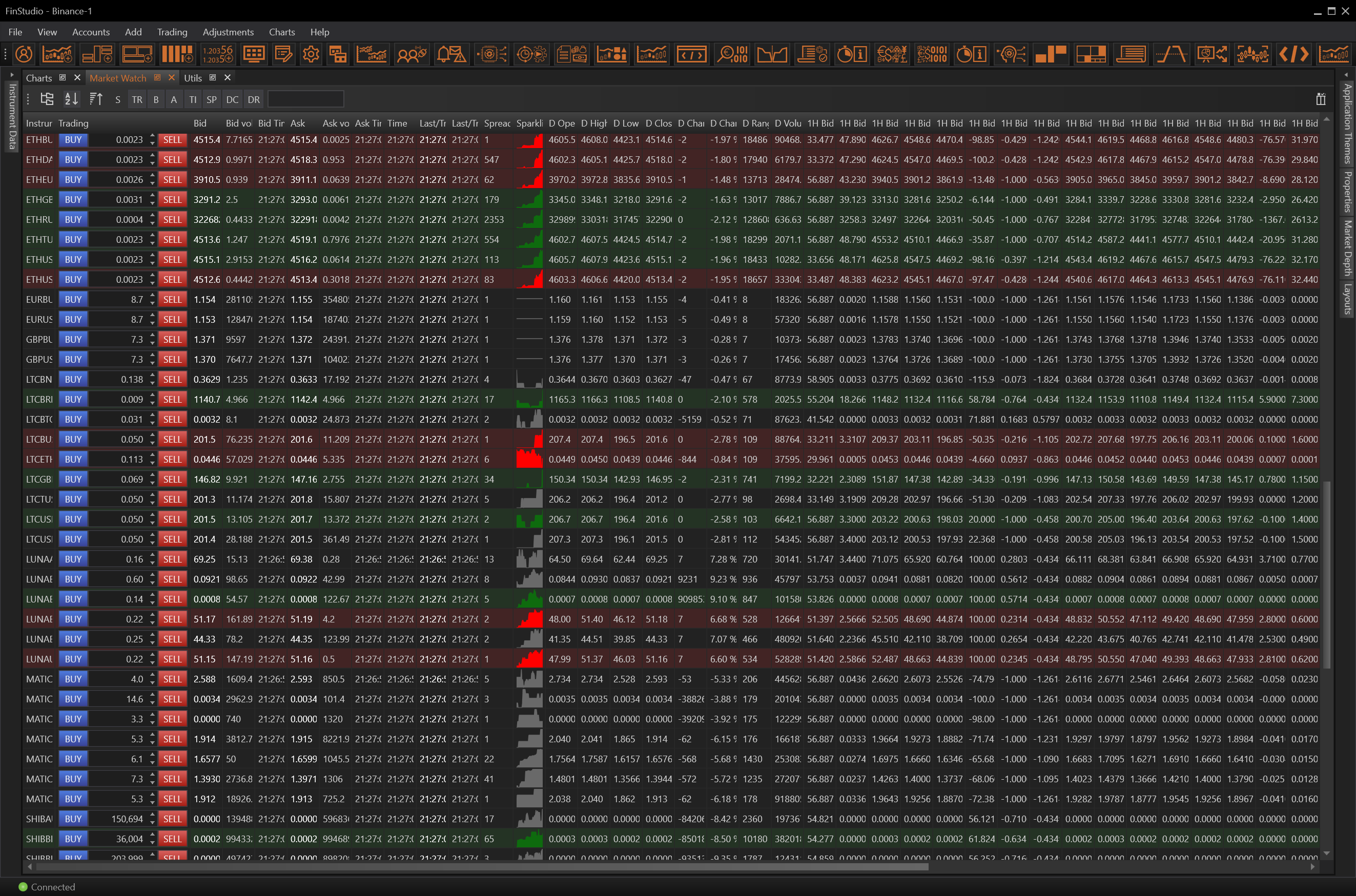

In FinStudio's Market Watch, the flexibility to choose from different viewing options for displaying instruments caters to diverse trading styles and informational needs. This adaptability ensures that traders can configure their view to best suit their analytical approach, enhancing both usability and accessibility.

Viewing Options in Market Watch

Grouped Tree List:

- Organization: Instruments can be displayed in a grouped tree list format, which organizes them according to instrument groups. This could include categories like sector, asset class, or any other logical grouping.

- Customization: Users have the flexibility to show or hide specific groups, whether predefined or custom. This allows for a tailored view that can simplify navigation and improve focus on relevant market segments.

Regular List:

- Simplicity: The regular list format sorts instruments alphabetically, offering a straightforward and familiar way to view market data. This format is particularly useful for traders who prefer a no-frills approach to data display.

- Ease of Access: Alphabetical sorting makes it quick and easy to locate specific instruments, especially in a long list, enhancing the efficiency of the trading workflow.

Gainers/Losers Sorting:

- Dynamic Monitoring: This option sorts instruments based on their performance, distinguishing between gainers and losers. It is an effective way to immediately identify which instruments are experiencing the most significant changes during the trading session.

- Custom Parameters: Traders can customize how gainers and losers are determined by selecting different bases such as bid, ask, last price, or percentage change. This customization allows traders to align the display with their specific trading signals or decision-making criteria.

Benefits of Various Viewing Options

- Enhanced Market Insight: Different sorting methods can highlight various market dynamics. For example, the grouped tree list can show performance by sector or asset class, while gainers/losers sorting provides quick insights into market momentum.

- Adaptability: The ability to switch between different views according to trading needs or market conditions makes the Market Watch highly adaptable, supporting a wide range of trading activities from day trading to long-term investment analysis.

- Personalization: These viewing options cater to personal preferences and trading styles, allowing each trader to set up their workspace in a way that is most intuitive and effective for them.

Practical Application

A trader monitoring tech stocks for quick trades might prefer the gainers/losers view to spot immediate opportunities. In contrast, a fund manager focusing on diversification across sectors might opt for the grouped tree list to monitor various asset classes or sectors comprehensively. Similarly, a trader who needs a simple, quick lookup might find the regular alphabetical list most beneficial during fast-paced trading sessions.

- Accounts & Connection Management

- Data Management & Analysis

- Price Monitoring

- Charting

- Trading

- Scanners

-

Builders

-

Manual Strategy Builder

- Main Concept

- Operand Component

- Algo Elements

-

Use Cases

- How to create a condition on something crossing something

- How to create an indicator based on another indicator

- How to calculate a stop loss based on indicator

- How to submit stop order based on calculated price

- How to calculate a current bar price using a price type from inputs

- How to Use a Closed Bar Price

- Automatic Strategy Builder

-

Manual Strategy Builder

- Autotrading

- FinScript

- Trade Analysis

- Media Feeds

- Logs & Notifications

- UI & UX