- Accounts & Connection Management

- Data Management & Analysis

- Price Monitoring

- Charting

- Trading

- Scanners

-

Builders

-

Manual Strategy Builder

- Main Concept

- Operand Component

- Algo Elements

-

Use Cases

- How to create a condition on something crossing something

- How to create an indicator based on another indicator

- How to calculate a stop loss based on indicator

- How to submit stop order based on calculated price

- How to calculate a current bar price using a price type from inputs

- How to Use a Closed Bar Price

- Automatic Strategy Builder

-

Manual Strategy Builder

- Autotrading

- FinScript

- Trade Analysis

- Media Feeds

- Logs & Notifications

- UI & UX

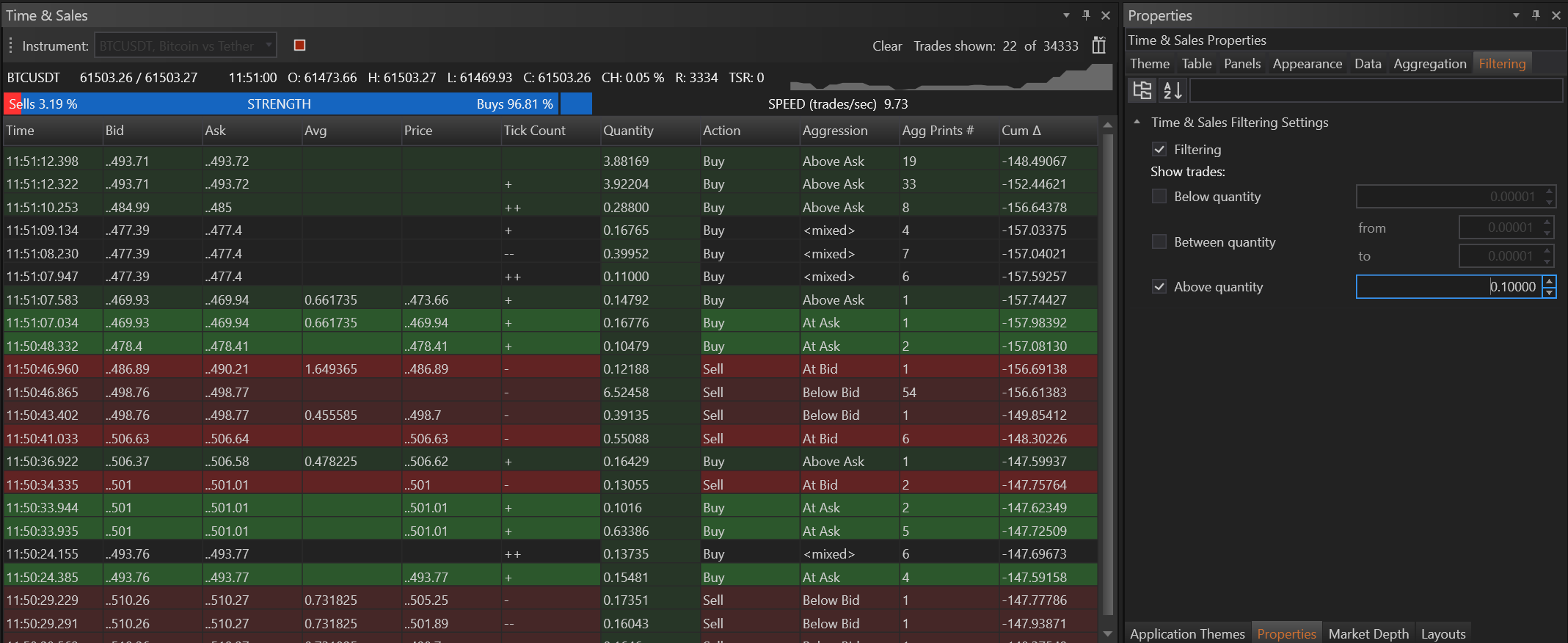

The Filtering feature in FinStudio's Time & Sales module is designed to enhance the usability of the module by allowing traders to focus on trades that meet specific criteria, particularly in terms of trade volume. This capability is crucial when traders need to isolate significant market moves or specific trading behaviors from the vast amount of data typically displayed.

Overview of Filtering in Time & Sales

Filtering works alongside aggregation to provide a clearer and more targeted view of market activity, by allowing traders to set thresholds for the trade quantities they are interested in monitoring. This feature is especially useful in fast-moving markets where large volumes of trades occur rapidly.

Key Aspects of Filtering Trades by Quantity

Categories of Quantity Filters:

- Below Quantity: This filter displays trades that are below a specified volume threshold. It is useful for traders who are interested in smaller, perhaps less impactful trades.

- Between Quantity: Trades that fall within a specified range of volumes are shown with this filter. It allows traders to focus on a middle tier of trade sizes, excluding both the smallest and largest transactions.

- Above Quantity: This filter is critical for identifying significant market activities. It isolates trades that exceed a certain volume, highlighting major transactions that could have a substantial impact on market prices.

Benefits of Using Quantity Filters

- Targeted Analysis: By filtering trades based on quantity, traders can focus on the market moves that are most relevant to their strategies. For instance, focusing on high-volume trades can be particularly important in identifying breakout or breakdown moves.

- Reduced Noise: Filtering out smaller trades helps in reducing the noise in the data stream, allowing traders to concentrate on significant trades that could indicate major market sentiment shifts.

- Efficiency: Traders save time and effort by not having to manually sift through all trades but instead focusing on those that meet predefined criteria.

Practical Application

For example, a trader monitoring a stock for potential large buyouts or sell-offs might set the filter to display only those trades with quantities significantly above average. This approach helps in quickly spotting when large blocks of shares are being bought or sold, which can be an indicator of institutional trading that often precedes significant price movements.

Setting Up Filters in Time & Sales

To set up filters, traders can access the filtering options within the Time & Sales settings:

- Select the Desired Filter: Choose from 'below quantity', 'between quantity', and 'above quantity'.

- Specify the Thresholds: Enter the numeric values that define the thresholds for each filter.

- Activate the Filter: Enable the filter to apply it to the data stream, which will then only display the trades that meet the specified criteria.

- Accounts & Connection Management

- Data Management & Analysis

- Price Monitoring

- Charting

- Trading

- Scanners

-

Builders

-

Manual Strategy Builder

- Main Concept

- Operand Component

- Algo Elements

-

Use Cases

- How to create a condition on something crossing something

- How to create an indicator based on another indicator

- How to calculate a stop loss based on indicator

- How to submit stop order based on calculated price

- How to calculate a current bar price using a price type from inputs

- How to Use a Closed Bar Price

- Automatic Strategy Builder

-

Manual Strategy Builder

- Autotrading

- FinScript

- Trade Analysis

- Media Feeds

- Logs & Notifications

- UI & UX